2023 brought a lot of change in our local markets as well as nationally. More than any other year, I have been asked questions regarding the state of the local market and what I think about the future. Typically I summarize this at the end of the year but given how much change we’ve seen over the previous 12 months, I thought it best to address this with a look ahead and the best data possible. I’ll take a look today at how these and more are affecting our local market and what the coming year may bring for buyers and sellers in Minnesota and Wisconsin.

The headlines from 2023 in real estate were meaningful and multitude including:

- Interest rates for mortgages were high and unstable – Locally I saw rates as high as 8% though more typically just under.

- An indicator of affordability continues to grow – the Case Shiller Index has risen dramatically since 2020 and continues to grow in 2023 – showing the difficulties buyers face on the market.

- Home insurance rates went up nationally at a rate of 21% in 2023; although this was less locally, it puts a pinch on homeowner finances and what people can afford.

- It got tougher to buy and finance a condo – As investigators got to the bottom of the Surfside Condo collapse of 2021, regulators implemented new rules aimed at ensuring the safety of condos.

- Commission lawsuits against big brokerages in 2023 and beyond will bring change to how we do real estate in the coming years, and potentially impact affordability for everyone.

2023 – A Year in Review

Nationally, home prices rose 5.2% through November of 2023 according to CoreLogic. Locally (in the Greater Minneapolis/Saint Paul Metro), we saw the average price of homes in our market rise by 1.7% during 2023 from $427k in January up to $434,000 through December of the same year. The table below shows this increase over the past two years.

Wisconsin as a whole experienced growth in median price by 7.6% in 2023 to $282,000. This growth is likely a result of affordability – simply comparing median prices across Minnesota as a whole ($327,200) and Wisconsin ($282,000) paints a picture of relative affordability. Some buyers took the opportunity to buy further out of the metro core, or across the border for affordability in 2023. Just using the example above and an interest rate of 7.596% a buyer who could make the pick the “average” home in Wisconsin over Minnesota stood to save $256 monthly in mortgage payments. While that may be offset by increased fuel costs and commuting time, it’s a calculation that works for some.

Sellers Staying Put

Closed sales in Minnesota were down 6.6% Year-over-year and 3.4% down in Wisconsin for the same time period. A recent article by Fast Company shows that more than 70% of homeowners with a mortgage have a rate lower than 4%. Practically this means a buyer who owns a house and is looking to upgrade (often called “move-up” buyers) may face large financial difficulties in making incremental improvements. I have done analyses for potential sellers looking to buy a home with one more bedroom and a little more square footage in the same area and found instances were the monthly cost (mortgage payment with PITI) is DOUBLE that of their current rate. This means sellers are less likely to sell and more likely to stay where they are resulting in less homes sold overall. There could be a change on the horizon with aging homeowners though – I will address this more at the end of this post.

Affordability Issues

I alluded to this in the bulleted articles above, and the effects of affordability make themselves known in everything we have talked about so far. The Case Shiller index measures home prices in 20 key metro markets across the US (including Minneapolis/Saint Paul) and directly compares same-home sales by reviewing sales growth for the same home in a weighted number. If you’re curious you can read more about it HERE. The bottom line is prices have grown consistently since 2012 and by 10% this past year alone. People who purchased and owned homes in the early 1980s like to mention that today’s rates are much lower than the 18% max of then, and the median throughout the early 80s was 12.82% on a 30 year mortgage. That’s certainly true, though that is mitigated somewhat by average home prices being less than 70,000 at that time. The reality is the current time presents unique obstacles to affordability. Home insurance in Minnesota rose an average of 21% and 15% in Wisconsin, further pinching homeowners in terms of monthly costs. Locally we were more fortunate than policy holders in places like Florida and California where insurers are reluctant to pay claims for repeated fires and storm damage some are reporting 50% or more. Some insurance companies have looked for reasons to drop policy holders or get out of insuring homes completely.

In some home styles – notably for Condominiums, Townhomes and Cooperatives (what Minnesota refers to as a “Common Interest Community”) new regulations impact affordability to buyers as well. Since the collapse of the Surfside Condo in Florida in June of 2021, these communities are under stricter guidelines by government and financial institutions. Notably, many associations who manage these communities are being forced to perform costly repairs and upgrades that were deferred or ignored historically. This means multiple associations I have shown properties in 2023 have included assessments (charges due by a unit) to fund such repairs exceeding $30,000. Either the current homeowner or the potential buyer need to take responsibility for these as a monthly payment often greater than $500. The result is undoubtedly a better, safer building and a more valuable unit, but not everyone can afford such a steep premium. Even those who have not needed repairs have found their master insurance policies go up tens of thousands in annual cost, resulting in similar short term dues increases. Those who don’t address these issues find their buildings are ineligible for many types of financing such as FHA, VA, and sometimes even conventional loans.

What’s in Store for 2024?

Lacking a crystal ball, it is impossible to say for sure but improving interest rates point to some potential relief. Outside of that, one major factor I could see turning the tide in pricing and shifting the market to favor buyers could be what some are calling the “Silver Tsunami.” Demographically, 10,000 baby boomers turn 65 years old, and this will likely bring about a change in housing stock in the coming years. The entire baby boom generation will be over 65 by the year 2030, and the change in their housing needs will be reflected by the choices they make now and in the coming years. Will it happen in 2024? Some experts say it’s likely.

Another major factor is interest rates; the recent rate situation from the fall was a major factor impacting affordability. There are indications that the Federal Reserve forecasts 3 rate decreases in 2024. If they are similar to the 25 basis points increases taken in 2023, we could see interest rates reach the low 5% range in the coming year. This would be a welcome savings for prospective buyers when you consider that .75% savings in the mortgage rate on a median home price of $385,000 (Twin Cities Region as of January 2024) saves a homeowner $150 a month on their mortgage payment.

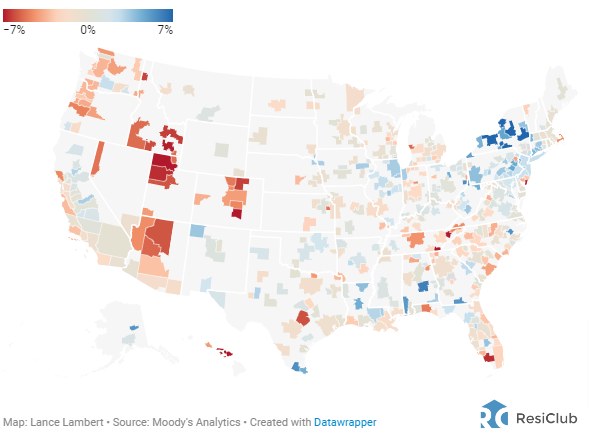

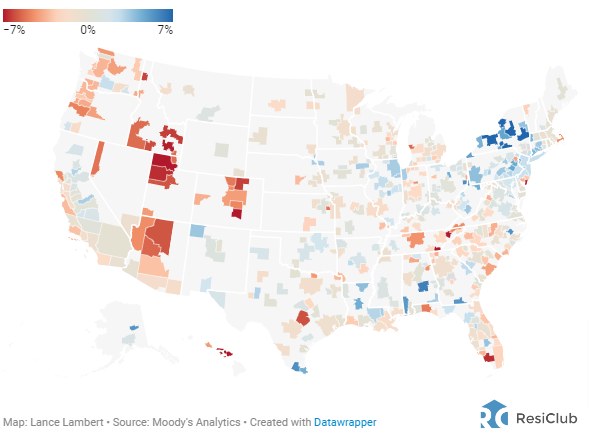

Another view from a writer I often find reliable where national trends are concerned is that of Lance Lambert. In a recent article for Fast Company, Lambert details forecasts by Moody’s Analytics and that predict our area (MN and Western WI) as having a flat or slightly downward trajectory of -1.2% for price change during the coming year. This would put us below the composite model for the US which predicts a 2.2% rise overall.

This graph shows data from the article linked above regarding expected price shifts for homes sold in 2024. Click image for interactive data.

The year is still young and the housing market is closely linked with the rest of the economy in most years, so how these factors all work together remains to be seen. Still, our markets have been more moderate comparatively over the past few years so I don’t believe a big bust is likely. I think the last part of 2023 and first part of 2024 have brought much of the decline we should see in the coming year, and a decrease in interest rates is likely to put slight upward pressure on pricing through increased buyer demand. Inventory still is unknown; will sellers take the opportunity of more buyers as a signal to sell? Only time will tell!

As always, your needs are unique so for a specific discussion about your buying and selling plans in 2024, please reach out! I am happy to do a market analysis on your home or discuss what a purchase might look like that meets your objectives.